Late last year, Ethereum’s transition from Proof of Work to Proof of Stake, the Merge, went down seamlessly, in an engineering feat that observers compared to swapping out an airplane’s engine mid-flight.

But it wasn’t until the implementation of the Shapella upgrade in spring 2023 that staking on Ethereum evolved into its fully-realized form. For the first time, holders were able to unstake their holdings, giving them newfound flexibility and removing the uncertainty of having to lock one’s holdings up for an indeterminate period of time.

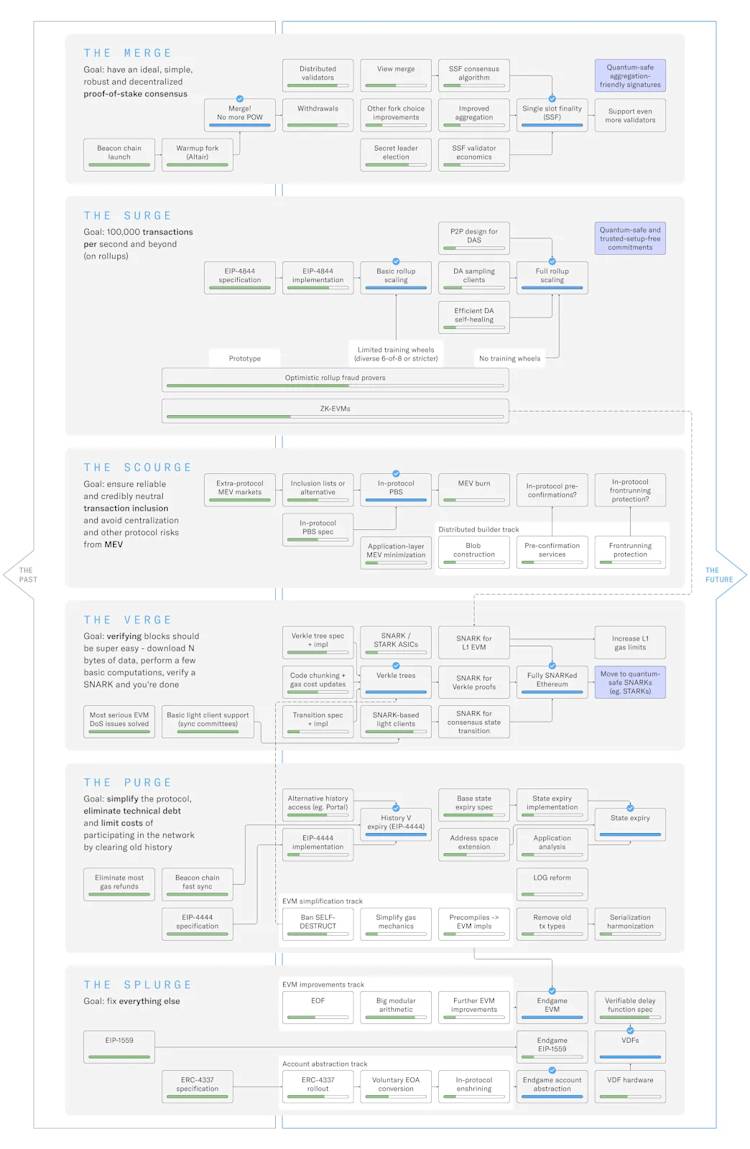

These were massive upgrades that multiple teams of developers worked on for years, but Ethereum developers aren’t simply sitting on their laurels or taking a victory lap just yet — they are working on a thoughtful and detailed long-term roadmap of additional upgrades which will proactively address some of the remaining challenges facing Ethereum now and in the years to come.

Broadly speaking, the goals for Ethereum over the next two to five years are to increase transaction speed, decrease transaction fees, and reduce technical debt (suboptimal code that has accumulated over the years) and network congestion, all while maintaining decentralization and the overall security of the network.

There is a lot at stake — Ethereum has a market value of $215 billion and TVL of $22 billion, so the Ethereum community is moving at a measured pace and proceeding slowly but deliberately to implement these changes. While Web 2.0 giants like Meta Platforms famously adhered to the motto “Move fast and break things,” the permanence of digital transactions demand a more intentional approach. There may not be much sound or fury, but the Ethereum community is more about technology than hype.

The quiet and focused way that Ethereum developers are going about implementing these changes doesn’t mean that they won’t be major updates. Today, software is ubiquitous and we don’t give much thought to updates that happen in the background as part of our day-to-day lives. But the upcoming updates to Ethereum will be profound, harkening back to an earlier time when upgrades from Windows 3.1x to Windows 95 were momentous occasions that brought meaningful advances and improvements. The Ethereum team is thinking big as they prepare Ethereum for the next level of mass adoption.

Read on for a discussion of each stage of the course that Ethereum developers have charted for the road ahead. The next step on the journey is the Surge. We’ll also briefly touch on the upgrades that are on deck after the Surge is completed.

Image source: X

The Surge

After completing the Merge last year and implementing Shapella this spring, the Surge is the next major upgrade scheduled.

The Surge was originally slated to go live at the same time as Shapella, but Ethereum developers chose to focus on activating staked ETH withdrawals on the Beacon chain first. This update was understandably made a top priority based on growing pressure to implement the ability to withdraw staking rewards, as some stakers had their holdings and rewards locked in for two years by this point.

Now that staking withdrawals are out of the way, the Surge will address some of the most critical issues facing Ethereum from a user experience and mass adoption standpoint — throughput and transaction fees.

The implementation of Surge related updates will help Ethereum to dismantle one of the main criticisms it faces — that it isn’t as fast as alternative layer-1 blockchains. This is a valid critique — right now, Ethereum averages 13 transactions per second (note that it can process up to 199 if all transactions are ETH sends) — a paltry total compared to rival layer-1s like Solana, which is averaging over 2,700 transactions per second and capable of processing 65,000 transactions per second. It also pales in comparison to the 65,000 transactions per second that legacy financial networks like Visa can process.

The Surge will also help to reduce Ethereum’s gas fees, or the cost of transactions on Ethereum, another point of contention for Ethereum critics. Transaction fees can reach as high as $20-$30 at times when there is heavy usage on Ethereum. If the network is to truly scale and reach mainstream adoption for everyday use, these fees will need to come down and become more predictable over time. If someone is buying an NFT priced at $40, paying a gas fee of $20 isn’t really feasible. If someone is swapping $100 of ETH for another ERC-20 token, a gas fee in this range is going to really dampen the appeal of trading. Even larger users and investors making larger transactions don’t want to pay these fees, which can curb the network’s monetary velocity.

Proto-danksharding, expected to occur during the first quarter of 2024, can be thought of as the baby steps towards tackling these challenges. By introducing EIP-4844 Proto-danksharding introduces the concept of data blobs, which reduce the cost of rollups publishing their data to the base chain. Proto-danksharding will reduce network burden and stress and reduce gas fees by anywhere from 10x to 100x. The average gas fee today is $31, for example, so with a 10x reduction as a minimum, this $30 fee would become a much more palatable $3 fee. At 100x, this $30 fee would become just a $0.30 fee. This will make a significant difference to the user experience and bolster usage on the network.

Further out, danksharding will be a bigger update that follows proto-danksharding. The introduction of danksharding will then significantly improve throughput, which will be a pivotal and monumental turning point for Ethereum and its user experience.

Sharding will alleviate congestion on the Ethereum mainnet by splitting up Ethereum’s workload across various Layer 2 blockchains, while the Ethereum mainnet will continue to provide execution finality.

These changes are expected to drastically increase Ethereum’s throughput to 100,000 transactions per second, an exponential increase from where it stands today. This evolution will lead to Ethereum’s throughput rivaling that of both alternative blockchains and TradFi payment networks. These changes will also help to significantly reduce the costs of transacting on the Ethereum network’s layer-2 blockchains, paving the way for a cheaper and better user experience.

The Verge

After the Surge, the next step is the Verge, which will introduce Verkle Trees to the network. This will enable users to serve as validators without the need to store extensive amounts of historical data on their machines. This will allow validators to operate more efficiently by freeing them up as they will no longer have to store large amounts of data to verify blocks.

The Verge will also boost decentralization because it will lower node requirements and reduce hardware needs and network overhead. This will reduce the cost of running a validator, opening the door to more participants and thus bolstering decentralization and security. Reaching statelessness, or full decentralization, is another key priority for Ethereum.

The Purge

Following the Verge, there will be another upgrade called the Purge. This aptly-named update will involve pruning historical data that is no longer needed.

The Splurge

The final stage of Ethereum’s evolution is the Splurge. While there aren’t many details at this point in time, Vitalik Buterin has said that this is where “all of the other fun stuff” will happen after the heavy lifting of the other stages is completed.

Looking Ahead

Ethereum has come a long way since 2013, but Ethereum developers aren’t stopping any time soon — they will continue to iterate on the network until it reaches its full potential.

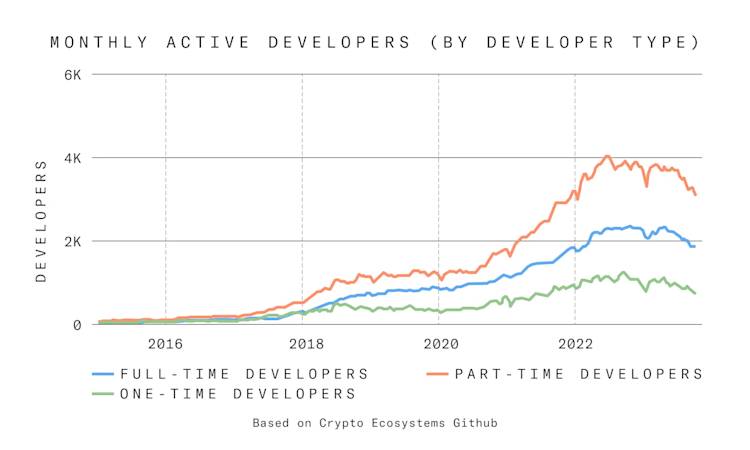

And it is an extensive and deep ecosystem of developers working towards this goal. One part of the Ethereum story that is sometimes overlooked is the size and scale of the development team working on it. Ethereum has 1,889 full-time developers working on it, and 5,769 monthly active developers. There are 38,332 total Ethereum repos and over 31 million total Ethereum commits.

In the second quarter of 2019, there were 2.9 million Ethereum SDK installs. By the second quarter of this year, the number was nearly 10x higher, with 26.8 million installs. The number of smart contracts deployed on Ethereum grew over 1,100% year over year in the second quarter of this year.

Ethereum can do many incredible things, but it’s capable of even more.The Ethereum team is thinking big as they prepare Ethereum for the next level of worldwide mass adoption.

Ethereum is in good hands as its core developers take a thoughtful and methodical long-term approach towards making the changes that will take Ethereum to its fully-evolved form.

About BitGo

BitGo is the leading infrastructure provider of digital asset solutions, delivering custody, wallets, staking, trading, financing, and settlement services from regulated cold storage. Since our founding in 2013, we have focused on enabling our clients to securely navigate the digital asset space. With a large global presence through multiple regulated entities, BitGo serves thousands of institutions, including many of the industry's top brands, exchanges, and platforms, as well as millions of retail investors worldwide. As the operational backbone of the digital economy, BitGo handles a significant portion of Bitcoin network transactions and is the largest independent digital asset custodian, and staking provider, in the world. For more information, visit www.bitgo.com.

©2025 BitGo Inc. (collectively with its affiliates and subsidiaries, “BitGo”). All rights reserved. BitGo Trust Company, Inc., BitGo Inc., and BitGo Prime LLC are separately operated, wholly-owned subsidiaries of BitGo Holdings, Inc., a Delaware corporation headquartered in Palo Alto, CA. No legal, tax, investment, or other advice is provided by any BitGo entity. Please consult your legal/tax/investment professional for questions about your specific circumstances. Digital asset holdings involve a high degree of risk, and can fluctuate greatly on any given day. Accordingly, your digital asset holdings may be subject to large swings in value and may even become worthless. The information provided herein is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. BitGo is not directing this information to any person in any jurisdiction where the publication or availability of the information is prohibited, by reason of that person’s citizenship, residence or otherwise.